Filing a tax return for a homeowner’s association (HOA) involves several steps, and the specific forms and procedures depend on the type of entity the HOA is classified as for tax purposes. Many HOAs are tax-exempt organizations, but they still have reporting requirements to the IRS. Homeowners’ associations that are federally tax-exempt under IRC Sections 501 also have reporting requirements to the IRS.

Determine the HOA’s Tax Status

Tax-Exempt Status: Most HOAs are set up to be eligible as nonprofit organizations under Section 528 of the Internal Revenue Code. Under this classification, the HOA is exempt from federal income tax on income that comes from member dues and assessments.

Non-Tax-Exempt HOA: In some cases, an HOA may be taxed on its income, such as from renting out property or other non-assessment-related activities.

Some common federal tax return types for HOAs

Form 1120-H (U.S. Income Tax Return for Homeowners Associations):

This is the most common form for tax-exempt HOAs that meet the requirements of Section 528. If the HOA qualifies, Form 1120-H simplifies the filing process by taxing only income from non-member sources (such as income from investments or renting out common areas) and exempting most other income.

Eligibility for Form 1120-H. Consider the below but not limited to:

- The HOA must be a homeowners association described in Section 528.

- At least 60% of the HOA’s gross income must come from member assessments (dues and fees).

- The HOA must primarily operate for the benefit of its members.

Form 990 (Return of Organization Exempt from Income Tax) for tax-exempt HOAs under IRC Sections 501:

If the HOA’s gross income exceeds $50,000 or it has significant non-exempt income (e.g., rental income from commercial properties), it may be required to file Form 990, which provides more detailed financial reporting. Smaller HOAs (under $50,000 in gross income) might only need to file Form 990-N (also known as the “e-Postcard”).

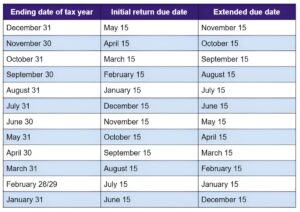

Return Due Dates for 1120-H

Generally, an association must file Form 1120-H by the 15th day of the 4th month after the end of its tax year.

However, an association with a fiscal year ending June 30 must file by the 15th day of the 3rd month after the end of its tax year. An association with a short tax year ending any time in June will be treated as if the short year ended on June 30, and must file by the 15th day of the 3rd month after the end of its tax year.

If the due date falls on a Saturday, Sunday, or legal holiday, the association may file on the next business day.

The association must pay any tax due in full no later than the due date for filing its tax return (not including extensions).

Return Due Dates for Exempt Organizations

(Extracted from IRS website, November 2024)

Who Must Sign

The return must be signed and dated by the president, vice president, treasurer, assistant treasurer, chief accounting officer, or any other association officer (such as tax officer) authorized to sign.

When in Doubt, Consult a Tax Professional

Tax laws and regulations can be complex, especially for organizations like HOAs. It’s often a good idea to consult a CPA with experience in HOA tax filings to ensure compliance and minimize potential errors. A CPA with expertise in CIRA industry should be able to help your association file its tax return accurately and on time.